Moment of truth looms for European green hydrogen investments

Energy transition highlights: Our editors and analysts bring you the biggest stories from the industry this week, from renewables to storage to carbon prices.

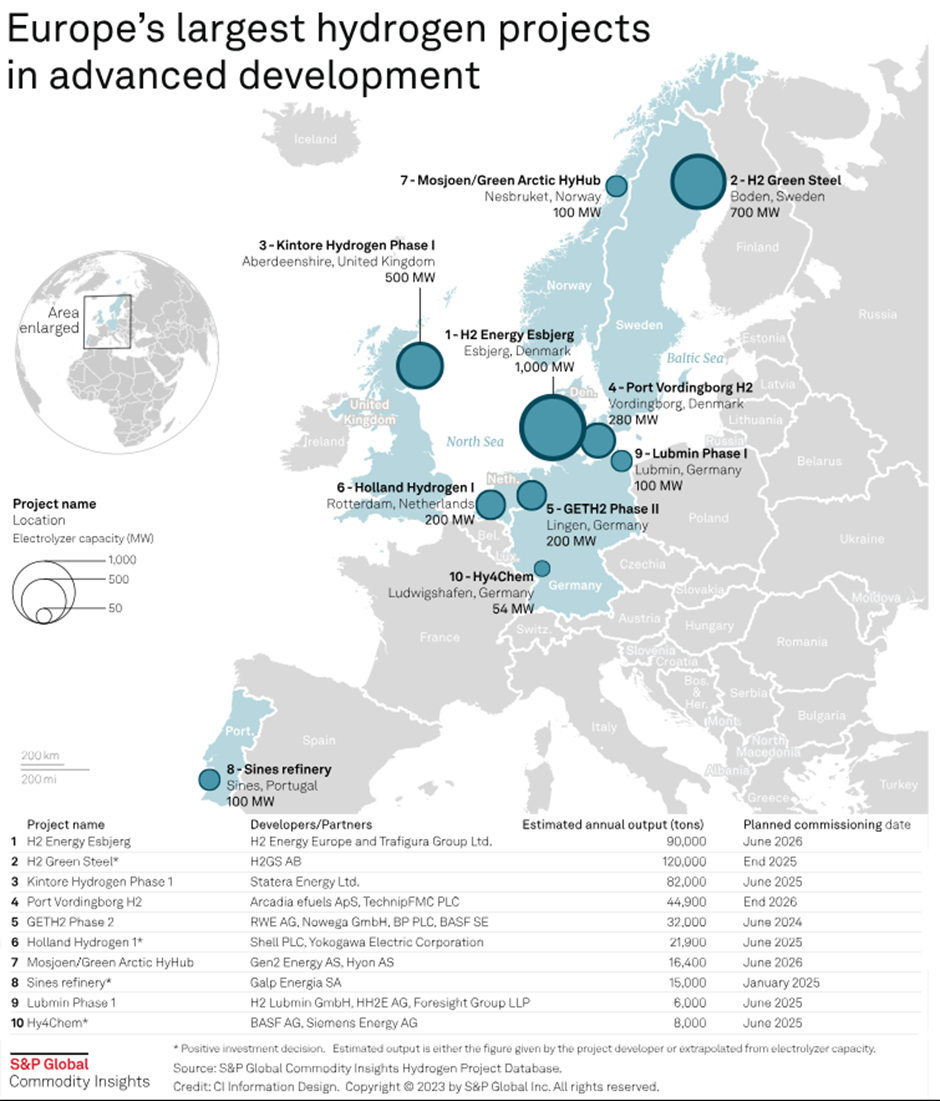

Time is running out to get on track with Europe's ambitious 2030 hydrogen production targets as developers due to take final investment decisions battle macroeconomic headwinds, industry representatives said at the Reuters Hydrogen conference in Amsterdam.

Recent years have seen a multitude of project announcements, pre-front end engineering design studies, FEED studies and preliminary investments, though FIDs have been scarce.

"There are some board rooms that are getting a little bit impatient by now," Rabobank Executive Director Hyung-ja de Zeeuw said April 9. "If you think that we’ve only got six years left until 2030, I guess 2024 is going to be a key year for clean hydrogen projects here in Europe."

Around 4% of announced clean hydrogen projects in Europe have taken FIDs, according to Hydrogen Council Director Policy and Partnerships Daria Nochevnik.

Price of the week: Eur4.50/kg

The price ceiling for the first pilot auction under the European Hydrogen Bank mechanism. Results will be announced April 30, with the fund expected to clear well below the cap.

Editor’s pick: Premium and free content

Biden's carbon capture plans inch closer to reality amid uptick in well permits

The Biden administration's ambition to capture carbon dioxide on a large scale and inject it back into the ground may have seemed daunting one year ago with only two CO2 storage facilities in the US. But a boost in federal spending on the technology in 2021 and 2022 may finally be bearing fruit after a sudden uptick in permits, according to industry watchers.

Australia to unveil new plan for clean energy, green manufacturing: PM

Australia will unveil a new plan in 2024 to support clean energy and green manufacturing projects to compete better against other nations’ subsidy schemes such as the US’ Inflation Reduction Act to draw investments in clean fuels, Prime Minister Anthony Albanese said, in what is being seeing as a pointer to big new fund allocations coming up.

Escalating geopolitical tensions may give carbon market a key role to play: GenZero

Carbon markets will be most critical in a scenario where global climate action is fragmented and geopolitical tensions are at their highest, as opposed to a scenario of full climate cooperation where carbon markets are least needed, Singapore’s state-owned decarbonization investment platform GenZero said.

European Hydrogen Bank pilot auction to clear well below Eur4.50/kg price ceiling

The first pilot auction for green hydrogen production under the EU’s European Hydrogen Bank facility will clear comfortably below the price ceiling of Eur4.50/kg ($4.89/kg), Innovation Fund policy officer Johanna Schiele said April 10. The results of the first Eur800 million auction will be released on April 30, Schiele said.

Hydrogen market developing in New York; regulatory, power market challenges remain

Using hydrogen to generate power in New York does not currently add up economically, but there is reason for optimism as the technology to do so will likely be needed in some capacity to help meet state decarbonization goals, experts said.

China’s CEIC starts construction of 100,000 mt/year capacity green ammonia project

China Energy Investment Corporation, one of the country’s largest state-owned energy companies, has started construction of its renewable ammonia project in Cangzhou in the eastern province of Hebei with a planned annual production capacity of 100,000 mt, likely to be completed by Q4 2025.